Opportunities and Challenges: Insights from the Pudong Furniture Expo on South American Buyers’ Guide to Finding New Furniture Suppliers

Introduction: Spotting Trends from a Busy Expo Floor

Picture this: the 2025 Shanghai Pudong Furniture and Home Expo buzzing with energy, halls packed tighter than a rush-hour subway in São Paulo. I was there, weaving through crowds, and one thing stood out—South American buyers were everywhere. Way more than anyone expected. Folks from Brazil, Argentina, Chile, and beyond, scribbling notes, snapping photos of sleek dining sets and upholstered chairs. It wasn’t just casual browsing; these were serious procurement teams hunting for deals.

This surge ties into bigger shifts. Traditional suppliers in North America and Europe are hitting roadblocks—tariffs jacking up costs, supply chains getting tangled in red tape. No wonder South American clients are looking elsewhere. China’s furniture scene, with its end-to-end manufacturing, flexible production runs, and improving designs that nod to global tastes, is stepping up as a solid alternative. It’s not perfect—distance and logistics can be a headache—but the potential? Huge.

That’s where this guide comes in. If you’re a South American furniture buyer tired of the same old sources, I’ll walk you through finding reliable Chinese partners. We’ll cover prep work, sourcing tactics, evaluation tips, and handling those inevitable hurdles. By the end, you’ll have a roadmap to snag suppliers that fit your market without the guesswork. Let’s dive in.

Pre-Sourcing Prep: Nail Down Your Needs and Positioning

Before you even start hunting, get crystal clear on what you want. I’ve seen buyers jump in blind and end up with mismatched inventory gathering dust in warehouses. Trust me, a little upfront thinking saves headaches later.

Clarify Your Market Positioning

Think about your end customers. Are you stocking high-end boutiques in Buenos Aires or Rio, where folks splurge on unique pieces? Or is it big-box stores in Peru or Chile, pushing volume at everyday prices? High-end spots crave premium materials like solid oak or sintered stone tops—durable, with that wow factor. Mass-market? Go for cost-effective MDF with veneers that mimic luxury without the price tag.

Then, nail the style. South American tastes often blend warmth with modernity—maybe industrial vibes with metal accents for urban apartments in Mexico City, or earthy tones echoing Andean influences. Decide if you need minimalist Scandinavian-inspired designs or something fusing local flair, like chairs with bold fabrics that pop against neutral woods.

Set Key Procurement Criteria

Price matters, but don’t make it everything. Are you chasing rock-bottom costs, or investing in value that justifies a premium? For instance, a sintered stone dining table might cost more upfront but lasts longer, cutting returns.

Quality and certifications? Essential. Look for FSC for sustainable wood—big in eco-conscious markets like Brazil—or low-formaldehyde standards to meet import regs. I’ve chatted with buyers who skipped this and faced customs nightmares.

MOQ is a deal-breaker. If your orders are small, say 50 units for a test run, avoid factories geared for thousands. And customization? If ODM or OEM is key—maybe tweaking a chair’s armrest for better ergonomics—prioritize suppliers with design teams.

Sourcing Channels and Strategies: Where to Find Top Chinese Suppliers

China’s market is vast, like navigating the Amazon River without a map. But smart channels cut through the noise. Here’s how to zero in on quality without wasting time.

Leverage B2B Platforms Efficiently

Start online—it’s quick and low-cost. Platforms like Alibaba International or Made-in-China are goldmines. Search for “upholstered dining chairs with metal legs” or “extendable MDF dining tables.” Filter by company age (aim for 5+ years), gold supplier badges, response rates over 90%, and real customer reviews. One tip: message a few with specific questions, like “Can you handle FSC-certified rubberwood?” Their reply speed and detail? Tells you a lot.

But hey, not everything’s online. Sometimes you spot gems in unexpected places, like a side conversation in a forum.

Dive Deep into Trade Shows (Our Top Pick)

Nothing beats face-to-face. The Pudong Expo? It’s a one-stop shop for China’s furniture pulse. In 2025, it showcased everything from sleek sintered stone tables to cozy boucle-upholstered armchairs. South American groups flocked to halls like the Modern Furniture Pavilion, eyeing designs that could fly off shelves back home.

Prep smart: Download the floor plan ahead, highlight zones like Brand Design or Outdoor Furniture. Jot down booth numbers for follow-ups. I remember one Argentine buyer who scored a custom line of walnut dining sets after chatting up a Tianjin-based factory rep. Pro move: Bring business cards in English and Spanish/Portuguese—bridges gaps fast.

Tap Industry Associations and Trade Bodies

Don’t overlook groups like the China Furniture Association. Their members? Often vetted pros with solid reps. Reach out for supplier lists tailored to exports. It’s like getting insider recommendations without the legwork.

Conduct Thorough Background Checks

Once you’ve got leads, dig deeper. If possible, visit factories—check production lines for modern gear like CNC machines ensuring precise cuts on wood frames. Watch quality checks in action.

Always request samples. Nothing beats holding a chair, feeling the fabric’s texture, testing the legs’ stability. One buyer I know avoided a flop by spotting flimsy welds on a sample metal base.

Evaluating Suppliers: Key Dimensions to Scrutinize

This is where you separate contenders from pretenders. Look beyond glossy catalogs—probe their operations.

Overall Capabilities

R&D and design: Do they have in-house designers cranking out fresh ideas? Ask for portfolios showing adaptable styles, like merging metal tubes with solid wood for that artistic edge.

Scale and equipment: Tour facilities for automated lines that handle volume without skimping quality. A factory with spray booths for even finishes on MDF tops? Sign of pros.

Quality control: Insist on seeing IQC for incoming materials, IPQC during assembly, and FQC before shipping. Data point: Top suppliers catch 99% of defects pre-shipment, per industry benchmarks.

Export and Service Prowess

Communication: Fluent English teams are standard, but Spanish/Portuguese speakers? A bonus for smooth deals. At the expo, I saw how bilingual reps sealed partnerships on the spot.

Export savvy: Grill them on South American shipments—do they know tariff codes for Brazil or Chile’s phytosanitary rules for wood?

Logistics: Good ones offer door-to-door options or partner with freight forwarders. Compare sea freight (cheaper, 4-6 weeks) vs. air (faster, pricier).

Navigating Challenges in Collaboration

No partnership’s smooth sailing. Here’s how to tackle common snags.

Communication and Time Zones

Beijing’s 11-13 hours ahead of South America. Set weekly video calls during overlap hours—maybe 8 AM your time, evening theirs. Tools like Zoom or WeChat keep things flowing. And yeah, cultural nuances matter; be direct but polite.

Payment and Risk Management

Play safe with letters of credit or escrow services. Avoid full upfront payments unless trust’s built.

Long-Haul Logistics and Inventory

Shipping: Sea’s king for bulk—cost-effective at $2-4K per container from Shanghai to Santos. Rail’s emerging for landlocked spots like Bolivia, faster than sea sometimes.

Stock smart: Keep buffer inventory but order in smaller batches to flex with demand spikes, like holiday rushes in December.

One quirky challenge? Weather—hurricanes delaying ports. Factor in buffers.

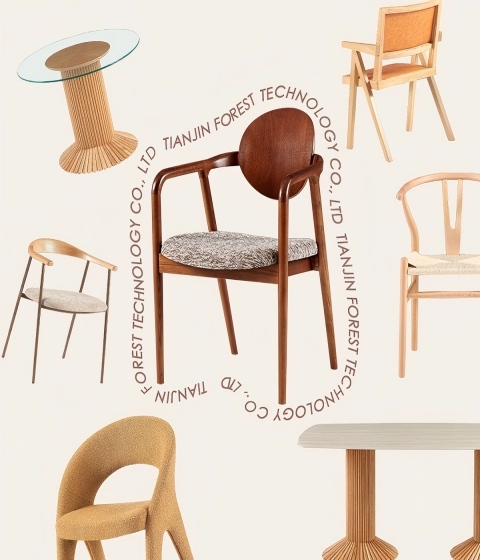

Spotlight on Forest Furniture: A Reliable Partner in the Mix

As we wrap up the guide, let’s talk about Forest Furniture, a standout player in this space. Based in Tianjin with factories across northern China, they’ve built a rep for blending solid wood pieces—like oak dining tables and rubberwood chairs—with upholstered gems such as boucle armchairs and modular sofas. Their lineup hits that sweet spot: durable MDF tables with trendy tops (think sintered stone or glass), all customizable via OEM/ODM. With exports to Europe, Southeast Asia, the Middle East, and yes, South America, they get regional needs—sustainable sourcing, competitive MOQs starting low, and teams handling Spanish/Portuguese queries. It’s not just products; it’s about partnering for growth, with a focus on quality that shines through in every stitch and joint.

Conclusion

Finding a new furniture supplier in China isn’t just about plugging a gap—it’s forging a bond that boosts your business long-term. With prep, smart sourcing, and solid evals, you’ll dodge pitfalls and grab opportunities. The Pudong Expo showed us: South America’s ready, and China’s got the goods. Take that first step—your next big win might be a booth away.

FAQs

What makes the Pudong Furniture Expo a must-attend for South American buyers seeking new suppliers?

It’s a hotspot for spotting trends firsthand, like the rise of sintered stone tables that suit humid climates in Brazil. Plus, you meet suppliers like Forest Furniture offering tailored designs, cutting down on virtual guesswork.

How can South American clients ensure quality when sourcing furniture from Chinese manufacturers?

Focus on certifications like FSC and rigorous QC processes. Request samples early—I’ve seen buyers test upholstery for fade resistance under South American sun. It weeds out the weak links fast.

What’s the best way to handle logistics challenges when importing furniture to South America?

Opt for sea freight for cost savings, but build in 2-3 week buffers for customs. Partner with exporters experienced in ports like Valparaíso— they know the paperwork drill, avoiding delays that eat into profits.

Are there specific trends from 2025 that South American markets should watch in Chinese furniture?

Absolutely—sustainable woods like rubberwood are hot, blending with metal for versatile pieces. Think extendable tables for compact apartments in Buenos Aires; they’re practical and stylish, driving sales in urban spots.

How do MOQs affect small South American retailers looking for new suppliers?

Lower MOQs, around 50-100 units, let you test waters without overcommitting. Suppliers with flexible production, like those at the Pudong Expo, make it easier—start small, scale as demand grows.